The following transactions were performed by the company during the month of June 2018. In the general ledger, two separate accounts are maintained for discount allowed and discount received. The total of discount column on the debit side of the cash book represents the total cash discount allowed to customers during the period and is posted to the discount allowed account maintained in the ledger.

How is Sales Tax Calculated

As such, the single-column cash book provides less detailed information than the double-column cash book. The difference between the two types of cash book is that a double cash book has two money columns (cash and bank) whereas a triple column cash book has three money columns (cash, bank and discount). Although single and double column cash books are alternatives to a cash account, the three column cash book serves the purpose of cash as well as a bank account. Cashbook is prepared like a ledger where the company’s cash transactions are recorded and entered according to date. It is a book containing the original entry and the final entry, which means that the cash book serves as the general ledger. In the case of a cash book, there is no requirement of a balance transfer to the general ledger, which is required in the case of the cash account.

Top 2 Practical Examples of Cash Book Entries

Balance, the last column shows ‘Cr.’ Alternatively, if the balance is a Dr. balance, the last column shows ‘Dr.’ An example of a typical bank statement is shown below. First, the opening and closing balances of the cash book are not posted. The cash column’s total on the debit side will always exceed the total of the credit side. At the end of the day, or at the end of the accounting period, the amount columns on both sides are totaled. The amount column is used to enter the amount received or paid as a result of a cash transaction.

Posting a three column cash book to ledger accounts

The purpose of cash and bank columns has already been explained at the start of this article. The purpose of the date, description, voucher number (VN), and posting reference (PR) columns has been explained in the single-column cash book article. deduction of higher ed expensess The procedure of posting entries from a cash book to ledger accounts has been explained in a single-column cash book article. The same procedure is followed for posting entries from double as well as triple column cash books to ledger accounts.

In the present modern world, almost all transactions done are using the company’s bank account. So, it was required to present one more column to the single-column cash book. Under double-column cash books, cash transactions and transactions through banks done by the business are also recorded. A cash book is a financial journal or ledger used in accounting to record a business’s cash receipts and cash payments.

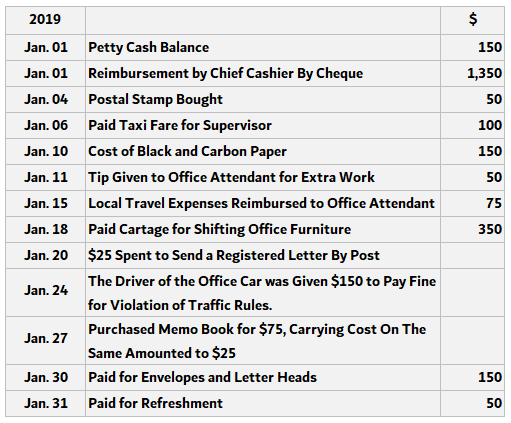

- The keeping of a cash book under the stated system is known as the imprest petty cash book.

- It is maintained more or less along the same lines as a businessperson maintains their personal accounts for debtors and creditors.

- The following Cash Book examples outline the most common Cash Books.

Reviewed by Subject Matter Experts

To simplify bookkeeping, she created lots of easy-to-use Excel bookkeeping templates. When an account holder deposits money with the bank, the bank’s liability to the account holder is increased from the bank’s point of view. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

As before the first three columns in the diagram are the date, transaction description (Desc.), and ledger folio reference (LF). The petty cash book may be considered to be a fourth type of cash book. The book in which these small payments are recorded is known as the petty cash book. The funds used for small payments are known as petty cash, and the person responsible for making and recording these payments is the petty cashier.

The 0.00 amount means no transactions have been entered into those months for the Cash Book. If you manually type anything into the Totals or Bank Balance columns you will over-type the formulas and the totals will be messed up. On downloading this cash book Excel may pop up with a yellow bar at the top advising the book is in Protected Mode. You will need to click on ‘Enable Editing’ to be able to use the book.