Particularly interesting may be the return on equity calculator and the return on assets calculator. Be sure also to visit the Sortino ratio calculator that indicates the return of an investment considering its risk. Negative working capital is never a sign that a company is doing well, but it also doesn’t mean that the company is failing either. Many large companies often report negative working capital and are doing fine, like Wal-Mart.

- What counts as a good current ratio will depend on the company’s industry and historical performance.

- For instance, imagine Company XYZ, which has a large receivable that is unlikely to be collected or excess inventory that may be obsolete.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- This can happen if the company is experiencing lower sales or cannot collect payments from customers promptly.

- Positive working capital is always a good thing because it means that the business is about to meet its short-term obligations and bills with its liquid assets.

Learn

Let us compare the current ratio and the quick ratio, two important financial metrics that provide insights into a company’s liquidity. Minimum levels of current ratio are often defined in loan covenants to protect the interest of the lenders in the event of deteriorating financial position of the borrowers. Increase in current ratio over a period of time may suggest improved liquidity of the company or a more conservative approach to working capital management. Time period analyses of the current ratio must also consider seasonal fluctuations. Current ratio, also known as liquidity ratio and working capital ratio, shows the proportion of current assets of a business in relation to its current liabilities. The Current Ratio provides valuable insights into a company’s liquidity.

Sample current ratios

A current ratio above 2 may indicate that a company has many cash or other liquid assets that are not used effectively to generate growth or investment opportunities. On the other hand, a current ratio below 1 may indicate that a company may have difficulty paying its short-term debts and obligations. In that case, it may need to increase its current assets or reduce its liabilities to improve its financial health.

Great! The Financial Professional Will Get Back To You Soon.

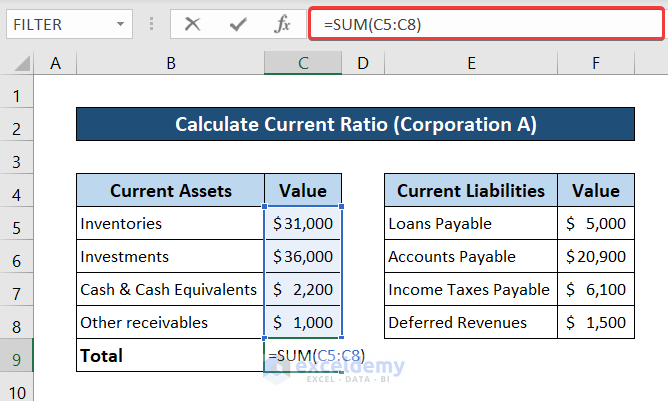

First, we must locate the current assets, which encompass cash, accounts receivable (outstanding payments owed to the company), and inventory (goods ready for sale). Combine the values of these items to determine the total current assets. The current ratio provides a general indication of a company’s ability to meet its short-term obligations, while the quick ratio provides a more conservative measure of this ability.

To see how current ratio can change over time, and why a temporarily lower current ratio might not bother investors or analysts, let’s look at the balance sheet for Apple Inc. Your goal is to increase sales (which increases the cost of goods sold) and to minimise the investment in inventory. Assume that a firm generates $2,000,000 in sales, and that the average inventory balance is $200,000.

Creditors are more willing to extend credit to those who can show that they have the resources to pay obligations. However, a current ratio that is too high might indicate that the company is missing out on more rewarding opportunities. Instead of keeping 5 great accounting blogs to subscribe to and read current assets (which are idle assets), the company could have invested in more productive assets such as long-term investments and plant assets. As you can see, Charlie only has enough current assets to pay off 25 percent of his current liabilities.

Companies, like Wal-Mart, are able to survive with a negative working capital because they turn their inventory over so quickly; they are able to meet their short-term obligations. These companies purchase their inventory from suppliers and immediately turn around and sell it at a small margin. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Our team is ready to learn about your business and guide you to the right solution.

On the other hand, the current liabilities are those that must be paid within the current year. The following data has been extracted from the financial statements of two companies – company A and company B. The current ratio is most useful when measured over time, compared against a competitor, or compared against a benchmark. A current ratio of less than 1.00 may seem alarming, but a single ratio doesn’t always offer a complete picture of a company’s finances.