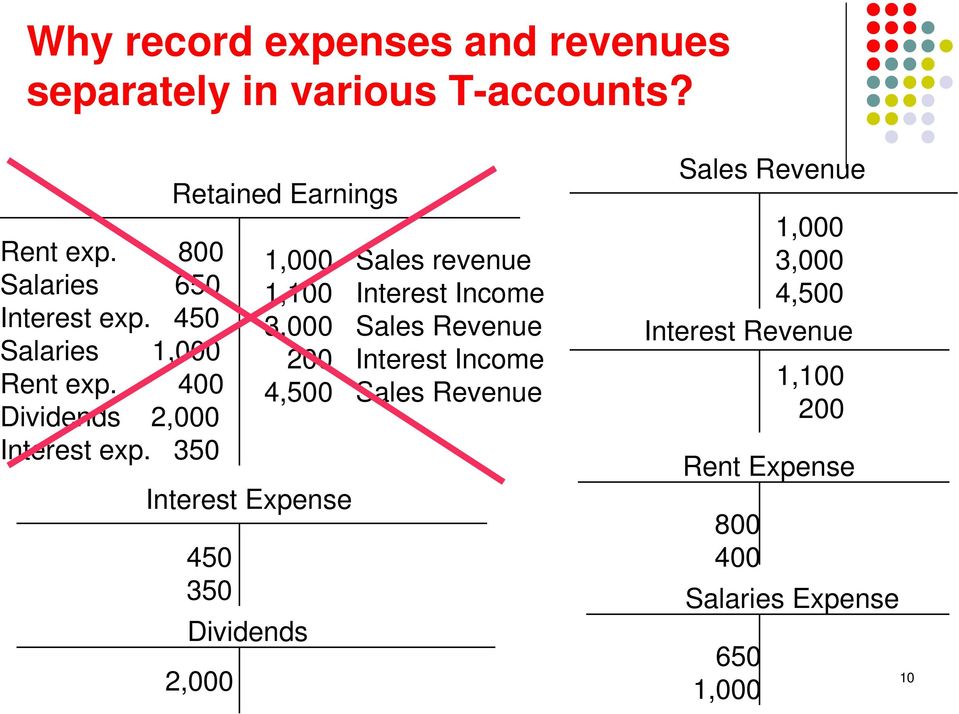

The money your business earns and spends is organized into subsidiary ledgers (also called sub-ledgers, or general ledger accounts). Sub-ledgers are like notebooks you use to write down business transactions as they happen. Then, you summarize that information in a master notebook—the general ledger. Most businesses use accounting software that posts all financial transactions directly to the general ledger. However, if you want to create your own general ledger, you’ll first need to understand the basics of double-entry bookkeeping.

Ask a question about your financial situation providing as much detail as possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. This type of general ledger can be used by sole traders who sell their own services or products to customers. The general ledger has been around since the days when the abacus was cutting-edge.

If your business is busy, and you find it hard to keep your books organized with this template, it may be time to consider double-entry bookkeeping. This lets you sign transactions in confidence, as apps within Ledger Live will never prompt you to sign malicious transactions. In the same vein, you also shouldn’t write down your PIN in unsafe places. Writing it down on your phone’s common size financial statement memory, in cloud-based services, or on sticky notes leaves you with that same vulnerability. In short, no one should have access to your secret recovery phrase, private keys or PIN code, no matter the situation. Creating the most secure crypto wallet involves testing both the physical components and the firmware.

- It’s considered to be the heart of all their business transactions since it provides users with the ability to gather information on sales, purchases, and cash flow.

- The accounting ledger provides users with the ability to keep tabs on their finances.

- The whole idea is they are built to last—with designs that resist water, fire and much more.

- If there’s an error and your books are out of balance, you’ll need to go back to make changes and create an adjusted trial balance or adjusting entries.

- To better understand the purpose of accounting ledgers, it’s helpful to understand how they differ from journals.

How budgeting and forecasting help SaaS companies reduce uncertainty and boost recurring revenue

If you decide to research double-entry bookkeeping, you’ll probably come across the term “trial balance” often. Trial balances are a financial tool specific to double-entry bookkeeping. If you choose to set up a double-entry ledger, you should be ready to prepare trial balances regularly. Software and malware attacks are common ways crypto wallets become compromised. If you use a hot wallet, which stores your private key on your host device, hackers may be able to extract your private key by targeting your smartphone or laptop with malware. Ledger devices mitigate this risk by keeping your private keys isolated from your internet-connected devices using the Secure Element.

And if you work with a professional bookkeeper (like Bench), good news! And your bookkeeper can always walk you through your GL if you have questions. Just know that when your bookkeeper prepares financial statements for you, they’re pulling from the general ledger. Even when using codes, your records should still include a description of each transaction. Then, even if you pass your books on to an accountant or bookkeeper, the descriptions will help them track what’s what. These codes are sometimes called an “account number.” In this example, all puppet-making-material purchases are coded 205, all sales revenue is coded 103, and so on.

Asset Management

Put simply, you should never connect to untrustworthy smart contracts or platforms using an account containing valuable assets. Connecting to potentially untrustworthy platforms is suitable for your minting account only, and failure to segregate these approvals could leave your assets at risk. To learn more, check out the article on how to segregate your crypto assets effectively.

What’s the Difference Between a Journal and a Ledger?

The main purpose of an accounting ledger is to keep track of all financial transactions that have taken place within a business. It allows users to gather information on sales, purchases, and cash flow which can be used for reports such as balance sheets and income statements. Whether you’re filing taxes or creating financial statements, it’s important to have access to accurate accounts for reference. It’s a handy resource listing all of your journal accounts as debits and credits.

But for the purposes of this article, it’s important to know that Ledger is an ecosystem of solutions combining hardware and software to improve web3 accessibility. A bank statement is essentially a record of all the activity within an individual account, showing the date of each transaction. The entries in both of these asset accounts will amount to $3,000 each.

If you’re more of an accounting software person, the general ledger isn’t something you use but an automated report you can pull. Your software of choice will probably have an option to “View general ledger,” which will show you all the journal entries you’ve entered (for a given time frame). Some general ledger accounts are summary records called control accounts. The details to support each control account are normal profit definition maintained outside in a subsidiary ledger.

Accordingly, Sage does not provide advice per the information included. These articles and related content is not a substitute for the guidance of a lawyer (and especially for questions related to GDPR), tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel. Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content. This report can often be generated and customized in your accounting software. The type of accounts that will appear accounts receivable procedure and checklist free template in your ledger will depend on the type of business you run (i.e. service-driven vs. product-driven), the scale of your company, and your operating processes.